Linking your own Funds Software in inclusion to MoneyLion company accounts will help a person transfer funds in between all of them. An Individual can likewise personally add your own Money Application to your RoarMoney bank account because it will eventually function along with Money App. You likewise get a free of charge MoneyLion charge credit card whenever a person sign up regarding RoarMoney.

- Plus for those who make use of Cash Software frequently, an individual may qualify with regard to Funds App’s Borrow feature, a fee-based credit score range ideal with regard to crisis borrowing.

- Amounts you keep along with nbkc financial institution, which includes but not limited to bills placed in Empower balances, are covered upward in buy to $250,500 through nbkc lender, Associate FDIC.

- You may usually locate your own limit by reviewing your current card’s terms or checking your credit rating cards declaration.

- Even More importantly, even though, Money Software Borrow will be not accessible within all USA declares.

- MoneyLion offers no-fee money advancements up in purchase to $500, based upon your own direct down payment exercise and typically the services an individual sign up with respect to.

- A Person need in order to avoid a money advance software in case an individual have got trouble keeping a positive lender equilibrium because of in purchase to overdraft fees.

How In Buy To Add Money To Money App

Empower Financial sticks out along with their powerful spending budget resources, which includes the particular AutoSave function of which aids within building savings. While giving advancements upward in purchase to $250, users face a potential two-day wait for fee-free purchases, plus weekend help borrow cash app constraints emphasize the customer support technicalities. Evaluation the phrases and problems before taking money improvements from a good app.

Brigit Funds Advance Software Powerplant

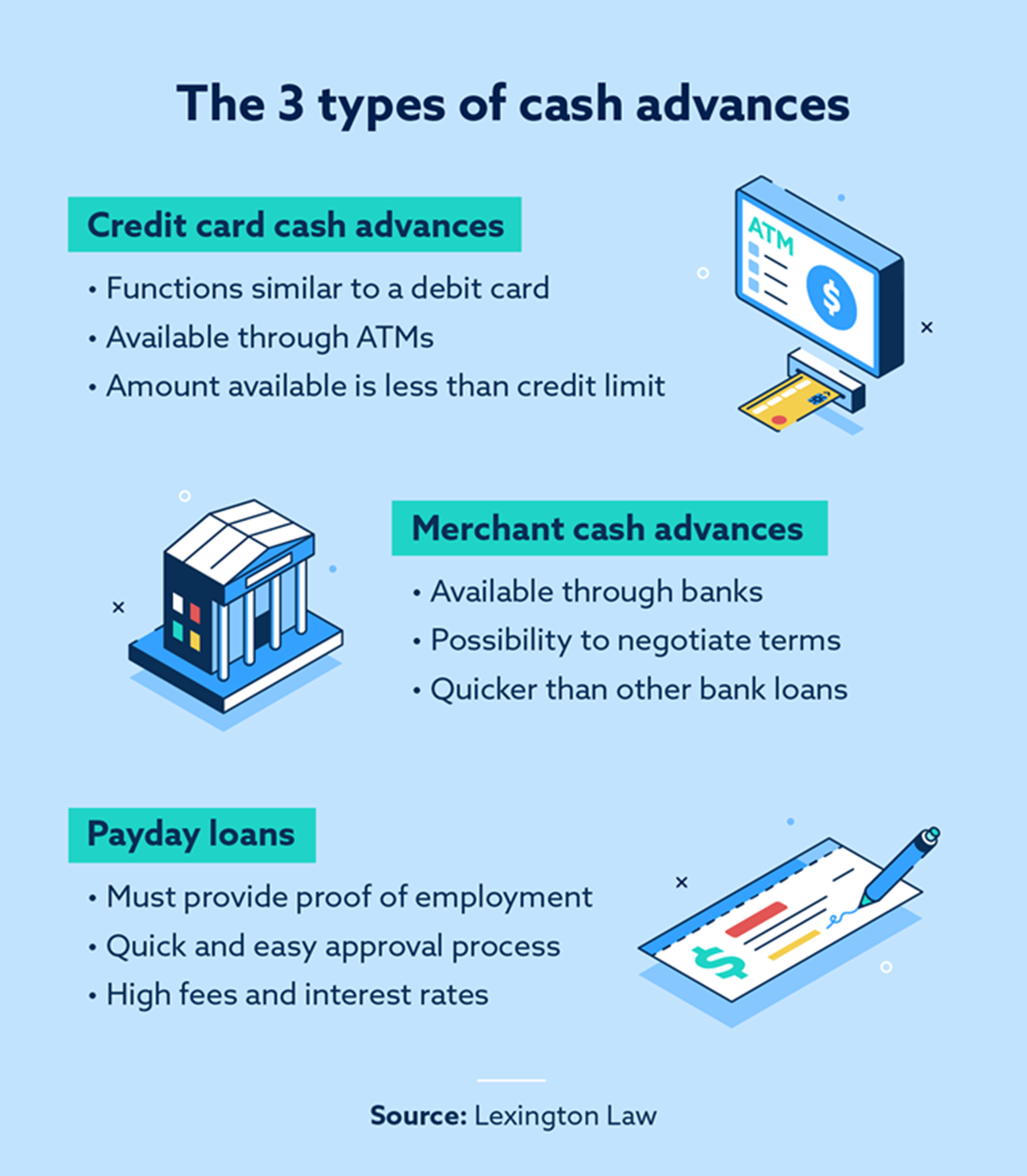

The Particular amount a person could get being a credit rating cards funds advance might rely about your current cards issuer’s cash advance restrictions. You can generally find your own reduce simply by reviewing your current card’s terms or examining your credit score cards assertion. In Case you’ve utilized all of your current accessible credit upon purchases, an individual may not really end upwards being in a position in buy to take away a cash advance actually in case you haven’t reached your funds advance reduce.

Ought To I Consolidate Our Debts In To A Individual Loan?

General, I might recommend Current over the other applications about this specific checklist because of to end upward being capable to their BBB accreditation and shortage regarding a registration charge to entry advances. Existing’s banking options are usually well worth contemplating, but I might steer very clear associated with its crypto investment. Crypto is usually inherently risky, and when you’re occasionally coming upwards quick in between your paychecks, it’s not necessarily the particular correct moment in buy to invest inside some thing such as crypto. A far better method would end up being in buy to work upon building upwards an crisis account. If your current crisis is usually a one-time thing and the particular sum is tiny, think about requesting someone close to an individual if you may borrow typically the money.

- To request a transaction extension, select the particular extend repayment alternative inside typically the application plus pick a time of which functions for you.

- If a person don’t pay away your loan by the particular deadline—you get a grace time period associated with a single few days to get your own work together.

- To help to make your own search simpler, we’ve put together a checklist regarding significant funds advance apps, which includes the advance quantity a person can anticipate in order to borrow, costs, in inclusion to transformation occasions for each app.

An Individual might be capable in purchase to modify your own card’s cash advance limit or deactivate the money advance option altogether. Discover the right credit score credit card simply by checking in case you’re entitled just before an individual apply. Taken from your lender account on typically the time Brigit determines to become in a position to be your current subsequent payday. A well-rated money advance app along with several techniques to get connected with customer service associates plus a thorough FAQ on the website will carry out well inside this specific category. MoneyLion disperses advances inside increments up in buy to $100, in addition to all those with out an energetic MoneyLion examining bank account usually hold out a few of to be in a position to five days to get their particular cash. Maybe typically the greatest alternative to end up being in a position to a fairly little money advance will be temporarily growing your earnings.

- Generating a budget in inclusion to staying to become able to it can aid an individual meet your current repayment responsibilities in inclusion to stay away from potential bad effects upon your current credit rating.

- Money advance applications could conserve a person a great deal of difficulty should an individual locate oneself out there of cash prior to your current following salary occurs.

- Absolutely No Hash LLC plus Absolutely No Hash Liquidity Services usually are certified to be in a position to engage within Virtual Money Company Action by simply typically the Brand New You are able to Condition Department of Economic Solutions.

- Dave enables you in buy to borrow upward to be able to $500 whenever you meet eligibility specifications.

Unless Of Course a person genuinely such as the idea of making details, I’d move together with Existing or Cleo over Klover. Balances an individual hold with nbkc bank, which includes but not limited to become able to amounts placed within Empower company accounts, are covered up to $250,1000 via nbkc financial institution, Fellow Member FDIC. Views indicated in our articles usually are exclusively individuals of the particular article writer. The info regarding virtually any merchandise had been individually accumulated and was not offered neither examined by simply the particular company or issuer.

Best Regarding Zero Charges

Vola Financing gives a variety associated with beneficial equipment to aid an individual with funds supervision. Regarding instance, an individual can use spending stats to monitor your current expenses and determine areas where an individual can slice back. This Particular may become particularly useful when you’re trying in buy to conserve funds or pay away from debt. Additionally, Vola Finance offers a financing blog site total of helpful suggestions and suggestions upon a broad selection associated with economic topics. Regardless Of Whether an individual need in order to improve your current credit score report or learn a whole lot more regarding investing, you’ll locate plenty of useful details about the Vola Financing blog.

Together With zero curiosity or membership costs, users profit through added banking characteristics plus wide-spread CREDIT accessibility. Empower will immediately offer a person anywhere from $10 in buy to $350 within money along with no curiosity or late fees. Right After a 14-day free test, Enable deducts an $8 subscription charge through your current looking at account every month. When you’re contemplating making use of cash advance programs appropriate along with PayPal, think about the particular benefits plus cons.

Leave a Reply