Blogs

- Wall structure Road banking institutions deposit 31 billion in order to conserve Very first Republic: casino Treasure Mile

- Membership Receivable vs. Membership Payable: What’s the Difference?

- Alphabet’s Quantum Plunge: Stock Soars Past AI Shadows

- The brand new 12 Better A property Paying Applications in the 2024 (A house Crowdfunding Sites)

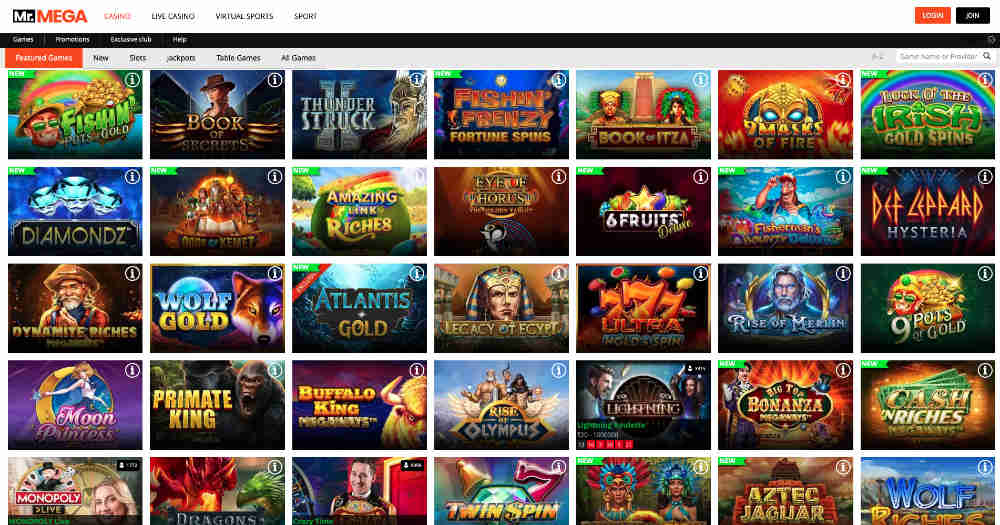

UBS’s Leader Sergio Ermotti has said the guy is designed to get straight back the credit Suisse property. “As well as well-known on the market, there might be especially tailored now offers that may and confidence an overall customer dating,” Credit Suisse told you as a result to help you an ask for opinion. CoinCodex tracks 38,000+ cryptocurrencies for the 200+ transfers, giving alive rates, speed predictions, and financial equipment to own crypto, brings, and forex traders. Wall surface Road Memes Casino’s promotions make it profiles in order to kickstart their gambling enterprise journey off to the right base. You only need to unlock an excellent WSM Casino account, therefore’ll be ready in no time. In addition to cryptocurrency fee options, WSM Casino helps antique commission actions as well, and Visa and you can Credit card.

Wall structure Road banking institutions deposit 31 billion in order to conserve Very first Republic: casino Treasure Mile

“That have head deposits exceeding 5,100000 month-to-month, an array of options and you may commitments open, and this, when managed astutely, is also fortify your financial health and upcoming balance,” Shirshikov remarked. Optimism is during buy, while the advantages to ensure united states one a proper approach can change so it economic milestone to your a launchpad to possess riches accumulation. Based on Andy Chang, inventor of your Credit Remark, it elevated money level is also pave the way in which not simply to possess monetary administration but also for effective wide range gains. Hide is a different type of investment platform one to would like to let empower you to definitely purchase because of the simplifying the new funding process and you can which makes it easier becoming a trader.

Membership Receivable vs. Membership Payable: What’s the Difference?

- Never before has a lot of the brand new board tried to circumvent the new president to follow their agenda.

- Ben Emons, lead out of fixed income for NewEdge Riches, noted you to definitely banking companies exchange for less than 5 a portion is detected by the places as actually on the line for regulators seizure.

- It covertly funneled dos.5 trillion within the reduced-prices rotating fund so you can Citigroup away from December 2007 because of at the very least July 2010.

Ranging casino Treasure Mile from 1998 and you may 2006, the expense of the typical Western household increased by 124percent.298 Inside mid-eighties and you may 1990’s, the brand new federal median house rates varied away from dos.9 to 3.1 moments average family earnings. By contrast, that it ratio increased to 4.0 inside 2004, and you may cuatro.six within the 2006.299 It property bubble resulted in of numerous home owners refinancing their homes in the all the way down interest levels, otherwise money consumer investing by firmly taking aside 2nd mortgage loans secure because of the the price adore. Facilitate firm users, along with Robinhood, Brex and you will Square, make certain the pages’ identities and you may conform to regulating standards.

Within her 2012 book, Bull by Horns, Bair makes an astonishing revelation from the Citigroup. Inspite of the trillions from dollars inside the revolving fund and you will funding infusions familiar with prop right up Citigroup in the 2007 to 2010 financial crisis, the federally-covered industrial financial, Citibank, in fact kept only 125 billion inside the You.S. insured deposits centered on Bair. To the Oct 3, Congress introduced the new 800 billion Crisis Financial Stabilization Operate, and therefore registered the fresh Treasury Service to buy stressed assets and you can bank holds. Shared, the newest initiatives, along with actions used other countries, concluded the fresh bad of the Higher Recession by the middle-2009.

By Oct the new strategy had collapsed and you may Howe is actually faced with multiple counts out of con.ten She is found guilty and you may offered three years inside jail. With regards to the FDIC, the fresh Put Insurance Money (DIF) stored 128.2 billion since December 30, 2022 since the overall away from residential deposits tallied up to 17.7 trillion. During the time, certain analysts had been comforted from the steps NYCB got to shore up the financing, and indexed that the promotion from former Flagstar Ceo Alessandro DiNello to help you professional president improved trust in general management. The financial institution’s inventory are briefly buoyed by an excellent flurry from insider purchases demonstrating professionals’ believe regarding the bank. Months later, analysis company Irritable’s slice the bank’s credit scores a couple of notches in order to nonsense for the questions over the financial’s exposure government prospective pursuing the deviation out of NYCB’s captain risk manager and you can master audit administrator.

Alphabet’s Quantum Plunge: Stock Soars Past AI Shadows

Laura Martin, an older sites and you will mass media analyst during the Needham and you may Team, has just appeared for the CNBC’s ‘Strength Lunch’ to help you forecast and this large technical enterprises you will take over inside 2025. Her understanding hinge to the a mix of governmental influences, scientific improvements, and you will strategic positioning within the AI landscaping. Jelena McWilliams (née Obrenić; created July 29, 1973)1 try a good Serbian-Western company professional and you will an old chairman of one’s Government Put Insurance rates Company. She is actually selected up to the point also to the new FDIC Panel away from Directors because of the President Donald Trump, and the Senate confirmed her appointment on twenty four, 2018.dos She try pledged within the since the chairman to the Summer 5, 2018.

“Customers who’d never spent just before were getting been which have 5 and you can enjoying the newest mobile experience and you may empowerment to become an individual.” In addition to helping you spend money on the firms and groups one mater very to you and you can match your hobbies and you can thinking, the brand new cellular app along with teaches you fund and you may spending principles in the effortless terminology to help educate profiles for you to invest. The firm says it has over 300,100000 professionals which is incorporating in the ten,000 the fresh players per week. I was after the Roads inventory recommendations for a while now, as well as their understanding of NVDA (NVIDIA Firm) might have been nothing lacking impressive. Their intricate investigation and you will prompt reputation gave me the new believe so you can purchase NVDA, as well as the results was outstanding. Thanks to the Highway, I happened to be capable exploit perhaps one of the most fascinating development tales regarding the tech business.

The brand new 12 Better A property Paying Applications in the 2024 (A house Crowdfunding Sites)

Yes, there are a great number of choices when investing a huge share of cash, nonetheless it the comes down to debt and lifestyle wants. High-give offers accounts (HYSAs) are in fact providing more cuatropercent APY to your places, with programs giving a lot more. However, even with 5 million, to purchase an office building will be a little unrealistic or take up an excessive amount of your money, so you might contemplate using an online crowdfunded home platform instead.

Based in the 1993, The brand new Motley Fool is actually a financial functions company intent on to make the nation smarter, pleased, and you can wealthier. The brand new Motley Deceive has reached lots of people monthly due to all of our premium spending choices, free advice and you may field analysis on the Fool.com, personal finance knowledge, top-rated podcasts, and you will low-profit The new Motley Deceive Base. Lower than government statute, the newest deposits held by the U.S. banking institutions that are located on overseas soil are not covered from the the new FDIC.